Meal And Entertainment Deduction 2024 – She has also worked at lifestyle publications including InStyle, Entertainment Weekly were temporarily allowed to deduct 100% of the cost of work-related meals and beverages at restaurants. . and the cost of the meal didn’t include a charge for entertainment. In 2021 and 2022, this deduction was temporarily enhanced to 100% as a pandemic-era measure. IRS Publication 463 has all the .

Meal And Entertainment Deduction 2024

Source : ledgergurus.comCheck, Please: Deductions for Business Meals and Entertainment

Source : www.ellinandtucker.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comMeals and Entertainment Deductions for 2021 22 – Spiegel Accountancy

Source : spiegel.cpaMeals and Entertainment Expenses under the Consolidated

Source : gmco.comMeals and Entertainment Deductions In 2024 | The Ray Group

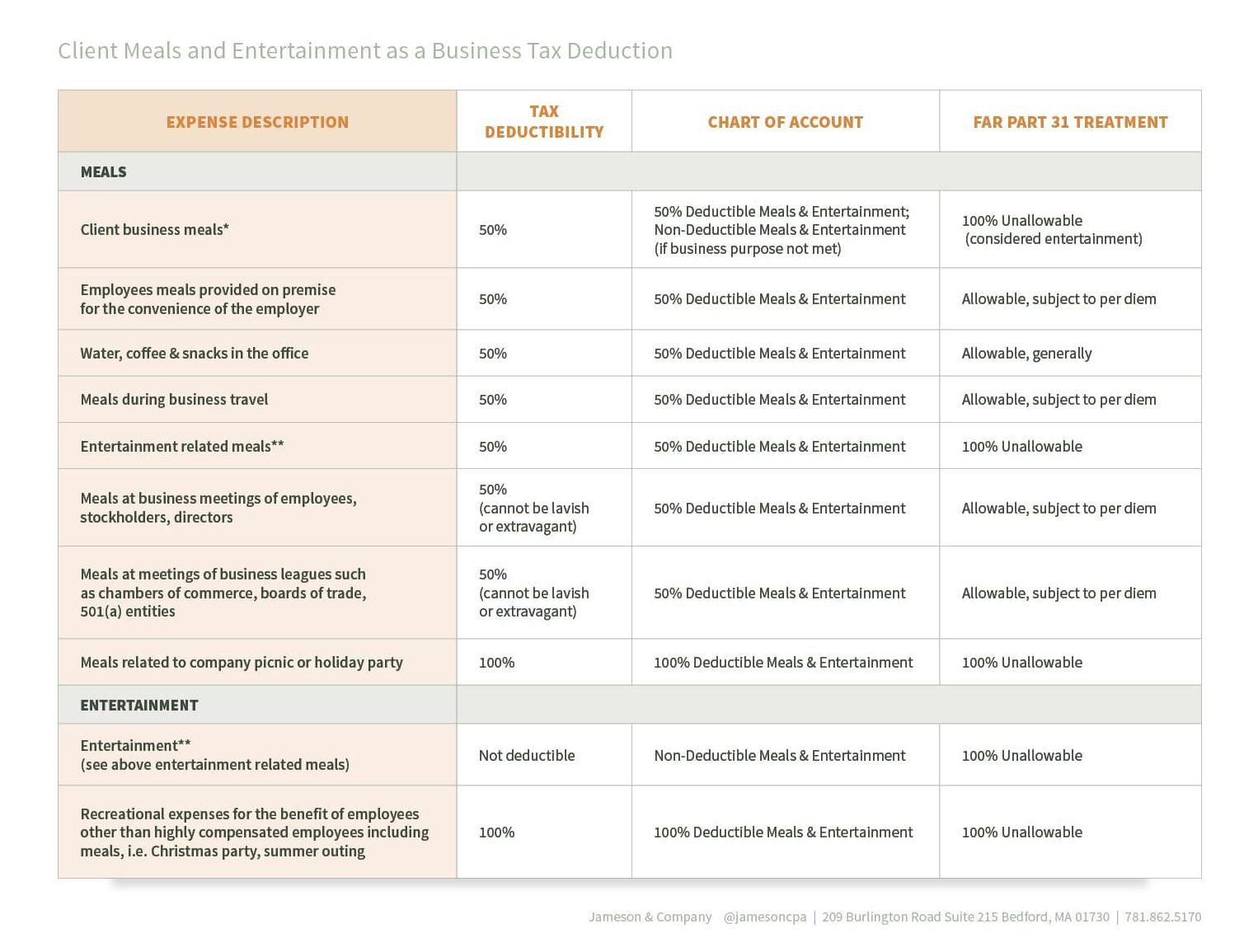

Source : theraygroup.usTrump Tax Law Affects on Meals & Entertainment Jameson & Company

Source : www.jamesoncpa.comExpanded meals and entertainment expense rules allow for increased

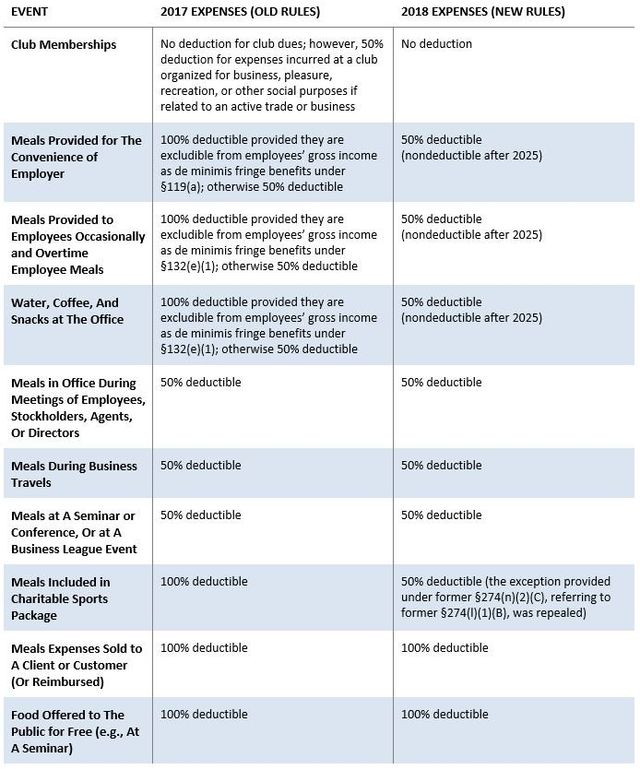

Source : www.plantemoran.comMeals & Entertainment Changes Under Tax Reform

Source : www.adminbooks.comMeal And Entertainment Deduction 2024 Meal and Entertainment Deductions for 2023 2024: Income tax deductions are an essential and legitimate way to reduce your tax burden. Every business or individual has a right to minimize its tax bill. However, sometimes people go too far, taking all . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

]]>